August was all about JPEGs, September will be all about Loot text - the next chapter of NFTs has arrived. Meanwhile, WHOOP is setting ambitious goals within the performance tracker market and it may be high time to alter the way we learn.

Text takes centre stage

From Late Checkout, by Greg Isenberg

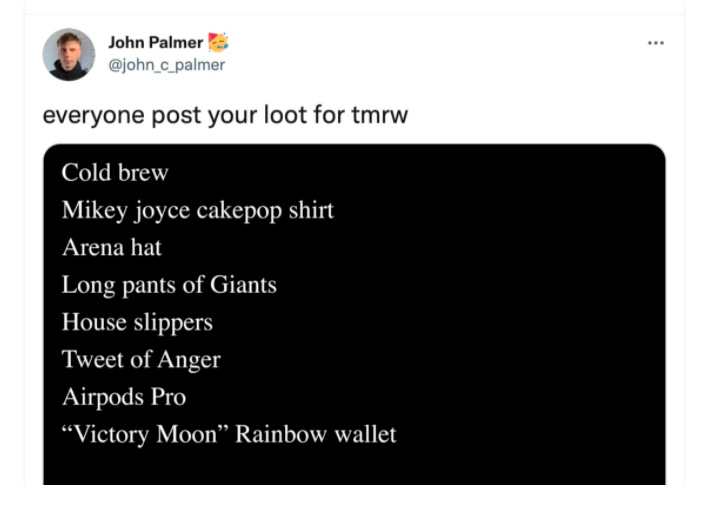

🚀 Loot launched on August 27th. It has already made over $24 million in trade volume. What makes it different?

It’s an entire new format, not simply an animal pic. By removing imagery Loot manages to perfectly hook a reader’s imagination.

It’s not just an NFT, it’s an ecosystem. Loot is run by its community. Loot sees a future where many owners and admirers will build on top of it.

It’s meme-able, not just shareable. Meme opportunities are easy with Loot, which is great for virality.

The future of NFTs: new game & community experiences, meme status and mystery.

Re-learn learning

From The Curiosity Chronicle, by Sahil Bloom

Learning is a skill. One we can improve and keep training in a way that fits with our consistently altering digital world (goodbye textbooks and footnotes).

A new approach could go something like this:

🔍 Identify & Establish

💻 Research

🗓 Skin in the Game

🧑🤝🧑Engage Community

👩🏫 Teach

🤔 Reflect & Review

Start with a blank page. Fill it with your current knowledge followed by new knowledge (first breath, then move to depth). Next, raise the stakes of your commitment, talk to others about your learning, solidify your knowledge by teaching it and finish off with some reflection.

What’s going on inside?

From Huddle Up, by Joseph Pompliano

WHOOP, a human performance company trusted by hundreds of athletes, just announced a $200 million series F investment. The company is now valued at $3.6 billion (up from $1.2 billion in October 2020).

With the cash, WHOOP hopes to expand internationally, improve member experience, develop new exciting features and hire awesome talent as consumers look to better understand their bodies.

The competition is fierce. Their main differential is the data (and its quality).

WHOOP successfully switched from an annual fee ranging between $500-$5000 to a $30/month subscription, considerably increasing their market reach.

Peloton’s Plummet

From The Flywheel, by Jake Singer

For its 1-year anniversary, Flywheel looks back to its first piece: Peloton.

A year ago, Peloton was thriving, but since the end of 2020 their financial profile has plummeted. While a post-COVID dip was expected, this is larger than expected. ☝️

Their hardware gross margin took a nosedive. Costs went up and price went down. Total OPEX grew to 59% in the last quarter.

Revenue growth has slowed, driven by hardware revenue. Hardware requires big bets upfront and Peloton’s gambling on new hardware products (treadmill, etc.) has not paid off.

Lessons from Web 2.0

👭 15 years ago there was a social network revolution. Future social apps must look back and learn from Web 2.0 ahead of the current social resurgence.

Growth matters. You can’t stop at building the app, you must grow your user base. Engagement is everything (Facebook and LinkedIn have teams dedicated to “people you may know” suggestions).

Too many connections is bad (solve the problem of maintaining connections).

Target one community and obtain saturation before adding neighboring networks.

Extra Reading

Binance founder on the U.S Crypto Exchange (Crypto Global, by Hannah Miller)

Communicating with different Stakeholders (Product Talk, by Teresa Torres)

Nifty corporates and their NFT awakening (Not Boring, by Packy McCormick)

Running your own race (The Jungle Gym, by Nick deWilde)

Every founder’s product hurdles (First Round Review)