Facebook’s next apology is most likely just around the corner, but into what kind of future will it invest its profits? Also, how should physicians get paid and what is the future of AI? The answers aren’t always easy.

Apology after apology

From Napkin Math, by Evan Armstrong

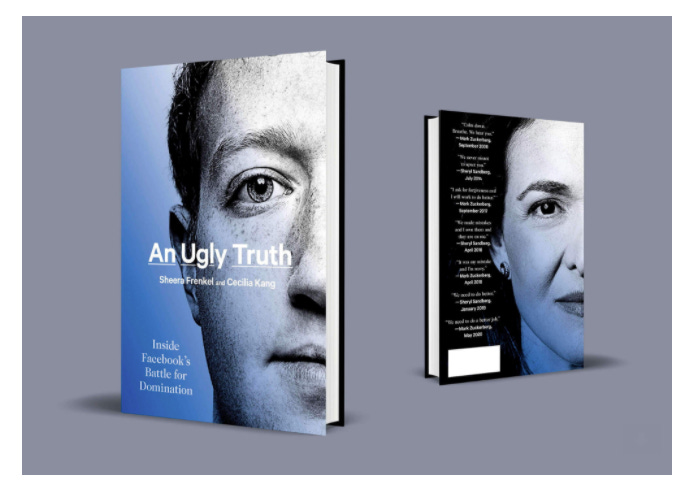

📖 An Ugly Truth: Inside Facebook’s Battle for Domination, examines the very tricky balancing act between good and harm at Facebook. Evan takes us through his own deep dive of this “stunning achievement of reporting.”

Facebook is forever evaluating what it is willing to pay to fix its problems. In 2019 Facebook blew through $3.7 billion to eradicate misinformation from the platform and a majority of society probably still think Facebook’s net impact is negative. Throughout COVID, however, Facebook did a whole lot of good. It kept us all connected, it shared uplifting and positive stories, especially during the BLM protests, and even its ads helped small businesses to compete and succeed against bigger corporations.

Yet of course, it still has costs. Over the last 4 years its failures included: the Myanmar genocide, January 6th riots in Washington partially driven by discussions on Facebook, Russian Interference in U.S. elections, blocked Political Dissidents in Turkey and ads selling fake Corona vaccines. The list could go on and on. An apology and a fine later and it’s back to growth numbers.

With 2.9 billion monthly active users (10 Americas), that’s about 139 billion posts to comb over every year. Apparently Facebook’s AI systems are doing a great job and keep improving but AI has not yet been able to completely solve content moderation. Around 15K contractors are also employed to look through posts that AI doesn’t catch.

This is of course not just a Facebook problem, it’s got more to do with the internet and the ugliness of human nature. But the thing is, when you look and see that Facebook made $10 billion net income in one quarter, with Zuckerberg as voting chief, there is definitely room for greater commitments to security to be made. It’s a company addicted to profit, or at least user engagement.

Political and societal changes are underway

From Exponential View, by Azeem Azhar

🚗 The great transition: Electric cars are finally being invested in with more rigorous and meaningful backing by automakers. The direction electric cars are heading in is exciting, due to the sheer possibilities and innovation on the horizon. They will be comparable to smartphones on wheels, relying on whole new business models (e.g. using subscriptions). The changes in transport will be huge.

🌝 Ladders to the Moon: AI models are getting bigger and better. Codex by OpenAI can literally write code for you (natural language to working code). And while AI is still more often lost on complex tasks, tools such as Codex can definitely help more of us become programmers, which companies are increasingly in need of. But the growth in AI will also have us think they know what they’re doing, until they don’t (see the Tesla crash). Bottom line, they are simply powerful tools. With complexity and power come both good and bad and large AI systems may only get us so far.

🇨🇳 China’s tech policy takes shape: A recent strike on consumer-facing tech businesses in China has brought with it speculation on the country’s tech future. China seems to be redefining what tech progress means for society. The Economist argued that, with everything from AI to self-driving vehicles, China will keep growing and evolving its tech ecosystem and consumer tech will no longer headline as much as it does in the West. AI is fueling China’s next industrial revolution.

🌱 Debt of decarbonization: Current CO2 level: 414.60 ppm; this time last year: 413.56 ppm; 25 years ago: 360 ppm; 250 years ago, est: 250 ppm. 3,252 days until we reach the 450ppm threshold. Only 11% per cent of the Pentagon’s $716bn annual budget would be enough to get wind and solar energy to every home in America. The climate crisis is at breaking point, the funds are there, now it’s about using our political capital wisely. (Alternative energy sources like hydrogen are central to reaching net-zero emissions, yet blue hydrogen is actually not that green, causing worse CO2 emissions than burning diesel for heat.)

Should money and physician care be separated?

From Out-of-Pocket, by Nikhil Krishnan

The care you receive from your clinician should be separated from any sort of financial motivation right? This is our current system when it comes to money and clinician care:

🤝 Clinicians can’t pay for referrals due to anti-kickback laws, yet hospitals can buy primary care groups who “refer internally” to other specialists and labs, so there are some referral patterns occurring down to financial interest.

🗣 Clinicians receive money from pharma and medical device companies for consulting fees.

💉 Doctors can be equity owners and founders in companies and run departments where trials and pilots are conducted (conflict of interests).

👩⚕️ The Corporate Practice of Medicine (CPOM) doctrine is supposed to prevent corporations/non-clinicians from employing clinicians to prevent care from being influenced. But each state enforces these very differently.

Overall it seems upper management and administrators are regulating who receives the financial upside and introduce rules for clinicians who determine how money comes to the health system. We currently have a system where clinicians are indirectly influenced by how the money is moving.

If a physician wants more money, they have to help hospitals or corporate entities optimize for more money. Personal financial upsides come from decisions at the top. Front line clinicians are pressured to keep hitting better outcome metrics but aren’t automatically paid more in return.

3 ways forward (a thought experiment):

Keep what we currently have. Trying to disconnect the link between clinician care and financial motivations to give hospitals more leverage as employees and optimizing fee-for-service care.

Clinicians become straight salaried with a fixed % increase in every speciality, with hard rules on any influence to care. Feels a little impractical and we would most likely lose talented clinicians who could get paid more in other countries.

Let clinicians make more money in ways of their own choosing but they will have to disclose everything and we would need a system that detects patterns of foul misconduct. The majority of clinicians care more about good patient outcomes than financial compensation. By forcing data into the open, undervalued clinicians may in turn see they are underpaid and have some bargaining power. You could also introduce incentives for clinicians to take part in value-based care setups and get paid accordingly for extra work.

Stop leaving your money in the bank

From Uncharted Territories, by Tomas Pueyo

Most of us are not prepared for retirement as many simply aren’t aware of the rules. A little research could make a huge difference.

🏦 Don’t leave your money in the bank. Making a choice early on to invest money outside of the bank account could 10X your wealth. One single day of putting your money in order could make you 10X more money than the rest of your 9-5 career. That’s compounding people. Think about when you want to retire and make some changes.

🧗♀️ The biggest hurdle: risk. People are too scared of potential loss to see the potential gains. While loss is always a possibility, how much risk you want to take is completely up to you. Don’t want any risk - invest in US debt.

🌈 Diversify. Don’t put all your money in one thing, but a bit of everything. That way you go with the whole market and reduce the risk of losing everything. A good way to diversify is to buy index funds (they invest in all the stocks). There are ‘roboadvisors’ that will help you diversify across all companies and government debts around the world.

💵 Reduce fees. Fees to investment advisors and commissions on funds make Wall Street rich but paying them can be avoided. Most financial advisors are bad so Tomas advises: invest yourself, find an amazing financial advisor, or use automated investment advisors—roboadvisors. As for commissions, make sure you find these costs before buying a fund (many make it hard to find). The most common is the expense ratio (an annual fee).

📉 Don’t try to beat the market. Even hedge funds rarely succeed in this. Most of us don’t know something the world doesn’t.

🧑🦳 Assume you’ll retire late and optimize your taxes.

Interviewing the world’s top biz executives

From The Profile, by Polina Pompliano

Julia La Roche interviews some of the biggest executives and often gets rare and close up access to CEO’s who don’t normally have time for sit-down conversation with journalists. Everyone from Google’s Sundar Pichai to Starbucks’ Kevin Johnson and Blackstone’s Stephen Schwarzman have sat across from her. In a live Q&A she talked about the significance of preparation, persistence and curiosity.

🎤 Favorite Interview: Mark Bertolini, CEO of Aetna. His move into health insurance was shaped by 2 major, life-changing events. His son’s rare lymphoma cancer diagnosis, of which he is currently the only known survivor of, and his spinal cord injury following a skiing accident. Both made him see the large gaps in the healthcare system.

🤓 Interview prep: When she decides on someone, she keeps a running page for notes from podcasts, books, interviews, articles etc - often they are several pages long - so that when the ‘yes’ comes through, there is a solid foundation. It’s crucial to always do your homework before interviewing anyone. Landing Salesforce CEO Mark Benioff took her three years, in which time she had read all four of his books.

🤷♂️ Questions: I always follow up on something that was said in a prior interview. Those that come out and own mistakes do a lot better than the ones that ignore them.

📚 Book recommendations on mentality: Robert Cialdini’s books (Influence & Pre-Suasion), Atomic Habits by James Clear, The Psychology of Money by Morgan Housel (highly recommend), Growth Mindset by Carol Dweck.

Extra Reading:

Avoid getting lost when mental models attack (The Curiosity Chronicle, by Sahil Bloom)

Brazil’s omnichannel powerhouse, VPNs and Streaming Price Discrimination and The Belt and Road Alternative (The Diff, by Byrne Hobart)

Major league baseball takes center stage in Iowa (Huddle Up, by Joseph Pompliano)

Contradictions in American diversity (The Pull Request, by Antonio García Martínez)

Keeping up with (writing) habit while traveling (The Long Conversation, by Rachel Jepsen)

Safe havens for money if everything falls apart (Contrarian Thinking, by Codie Sanchez)